What are mutual funds?

When you buy a mutual fund, your money is combined with the money from other investors, and allows you to buy part of a pool of investments. A mutual fund holds a variety of investments which can make it easier for investors to diversify than through ownership of individual stocks or bonds.

To many people, Mutual Funds can seem complicated or intimidating. We are going to try and simplify it for you at its very basic level. Essentially, the money pooled in by a large number of people (or investors) is what makes up a Mutual Fund. This fund is managed by a professional fund manager.

It is a trust that collects money from a number of investors who share a common investment objective. Then, it invests the money in equities, bonds, money market instruments and/or other securities. Each investor owns units, which represent a portion of the holdings of the fund. The income/gains generated from this collective investment is distributed proportionately amongst the investors after deducting certain expenses, by calculating a scheme’s Net asset value or NAV Simply put, a Mutual Fund is one of the most viable investment options for the common man as it offers an opportunity to invest in a diversified, professionally managed basket of securities at a relatively low cost.

How does a Mutual Fund work?

When you invest in a mutual fund, you become the shareholder of the selected mutual fund. The fund manger takes the entire pool of money from all of the fund’s investors and invests it in a carefully selected range of investments based on specific goals and procedures that are outlined in the fund’s prospectus.

The fund’s value keeps fluctuating from day to day. The NAVs of the funds don’t remain constant. The value of a fund’s units i.e. NAVs are updated on a daily basis and are available on the AMC’s website. Many factors like change in interest rates, economic trends influence the performance of a mutual fund. When you purchase units in a mutual fund, you agree to pay certain fees and expenses in the form of entry and exit load.

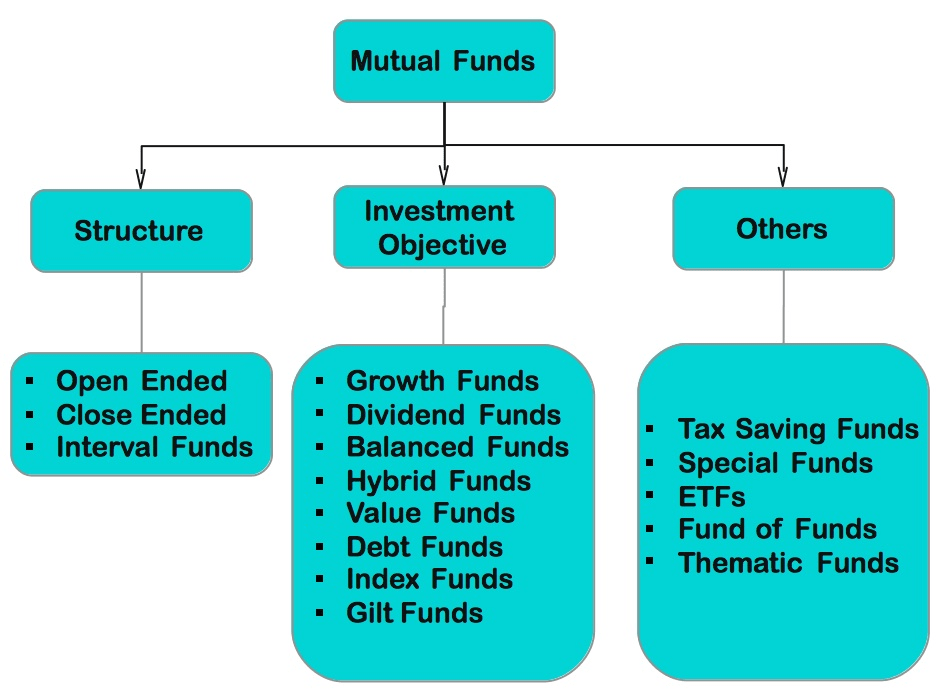

What are the different types of mutual funds?

What are the benefits of investing in Mutual Funds?

Many of us dread the thought of managing our own investments. With a professional fund management company, people are put in charge of various functions based on their education, experience and skills.

As an investor, you can either manage your finances yourself, or hire a professional firm. You opt for the latter when:

1. You do not know how to do the job best – many of us hire someone to file our income tax returns, or almost all of us get an architect to do our house.

2. You do not have enough time or inclination. It’s like hiring drivers even though we know how to drive.

3. When you are likely to save money by outsourcing the job instead of doing it yourself. Like going on a journey driving your own vehicle is far costlier than taking a train.

4. You can spend your time for other activities of your choice / liking

Professional fund management is one of the best benefits of Mutual Funds. The info-graphic on the left highlights all the others. Given these benefits, there is no reason why one should look at any other investment avenue.

When should I start investing in Mutual Funds?

There is a beautiful Chinese proverb, “The best time to plant a tree was 20 years ago. The second best time is now.”

There is no reason why one should delay one’s investments, except, of course, when there is no money to invest. Within that, it is always better to use Mutual Funds than to do-it-oneself.

There is no minimum age when one can start investing. The moment one starts earning and saving, one can start investing in Mutual Funds. In fact, even kids can open their investment accounts with Mutual Funds out of the money they receive once in a while in form of gifts during their birthdays or festivals. Similarly, there is no upper age for investing in Mutual Funds.

Mutual Funds have many different schemes suitable for different purposes. Some are suitable for growth over long periods, whereas some may be for those in need of safety with regular income, and some provide liquidity in the short term, too.

You see, whatever stage of life one is in, or whatever one’s requirements, Mutual Funds may have solutions for each one.

Mutual Funds

Mutual funds are the safest and the most convenient way of investing in the markets when you do not have the time and expertise.

The equity mutual funds have generated consistently higher returns. The investment in mutual funds can be a lump sum or monthly SIP for an amount as low as Rs. 500.

Concerns

- High-Risk factor

- Affected by movements in NSE/ BSE

- Fund houses charge expense ratio (1.05%).

Liquid Mutual Fund

The option carries the least amount of risk and is for persons who have idle money for short period of time.

The mutual fund invests your money in the highly liquid short term instruments like the bank’s CD, T-bills and commercial papers generally with a maturity period of less than 91 days.

Concerns

- Lower returns when compared to FD

- High risk factor.

Ultra Short Term Debt MF Plans

Unlike, liquid MF the money is invested in bonds and other instruments with maturity more than 91 days and less than 1 year.

Ultra ST debt MF does carry interest rate risk, are not so liquid and hence gives you higher returns.

Are there any tax benefits for investing in mutual funds?

Investments in mutual funds do classify for tax benefits. For specific provisions please refer to the respective offer documents.